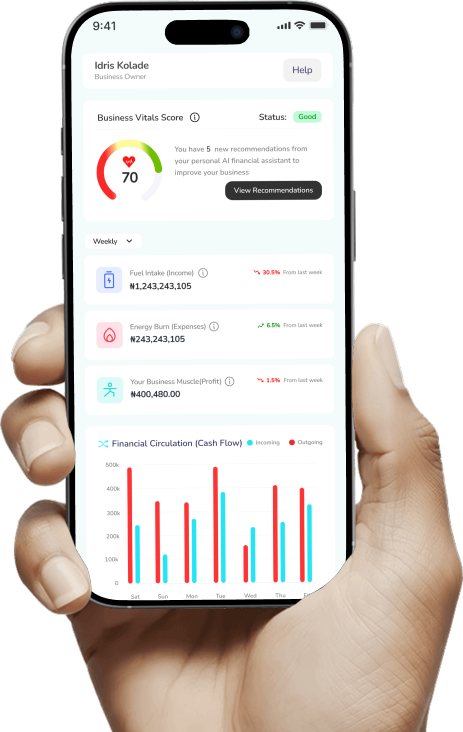

Your

Business Health, Monitored 24/7

Connect your accounting and sales tools, receive AI-powered alerts, and make confident decisions—anytime, anywhere.

BVS Is The Pulse of Your Business

Biz Vital Signs is your pocket companion for monitoring every critical metric of your micro or small business—across finance, marketing, and operations. We connect to QuickBooks, Xero, Stripe, and more, then deliver real-time alerts and AI-powered insights so you catch emerging problems before they become crises.

- pocket companion

- real-time alerts

- AI-powered insights

We Have Always Focused on One Goal: Helping Businesses Thrive.

Competitive Benchmarking.

See how you stack up against industry averages and peers.

Real-Time Business Health Score.

A single 0–100 rating blending 17 vitals—profitability, cash runway, efficiency, budget accuracy, and marketing ROI.

Seamless Integrations

Link your accounting (QuickBooks, Xero, Zoho) and sales/marketing (Shopify, Google Analytics, Stripe) in seconds.

How BVS Works

Biz Vital Signs (BVS) was born from a passion to empower businesses with the tools and insights they need to succeed.

Connect Your Systems

Let your financial blood flow—link your accounting and sales platforms or enter data manually.

Build Budget & Forecast

Answer a few guided questions to craft realistic monthly, quarterly, or annual plans

Monitor in Real Time

Watch your dashboard light up with incoming/outgoing cash, margins, and key KPIs

Receive Instant AI Opinions

From optimizing marketing spend to shoring up cash runway, BVS tells you precisely what to do—before it's too late

Benefits You Can Feel Immediately

BVS will redefine how micro and small businesses access financial consultancy with the launch of our BVS App

Proactive Management

Make decisions based on current data—never wait for the month-end close to find out you've overspent.

Stress-Free Planning

Replace spreadsheet wrestling with a few simple questions—then watch your forecasts build themselves.

Early Problem Detection

Spot cash dips or pipeline slowdowns at the first sign of trouble

Increased Confidence

Always know where you stand concerning your budget and benchmarks. Run your business with peace of mind, not worry.

Collaborative Edge

Complement your accountant and advisors—BVS fills the gaps between meetings with real-time insights

24/7 Dedicated support

Rely on personalized support from platform migration to optimizing your results and troubleshooting.

Who It's For

Find out if BVS can improve your business health

Digitally-Savvy Micro & Small Business Owners

(1–10 employees)

Entrepreneurs &

Solopreneurs

Who juggle many hats and need fast, clear insights

Managers Seeking

Visibility

Across finance, marketing, and operations—without complex dashboards

Small and Medium-sized Businesses

Ready to leverage mobile-first BI for competitive advantage

Meet Our Team

Meet the people powering Biz Vital Signs. Our team brings together experience in finance, tech, and business growth, all with one mission

Frequently Asked Questions

Everything you need to know about the product and billing.

How secure is my data?

Your data is protected with bank-level security. Biz Vital Signs uses industry-standard encryption (SSL/TLS), the same technology trusted by financial institutions. We never sell your information, and all connections to platforms like QuickBooks, Xero, and Stripe are secured through their official APIs. Only you control access to your account, ensuring your business data stays private and safe.

What happens if my accountant won't grant API access?

No problem! While API access makes it easier to sync data automatically, Biz Vital Signs can still work with manual uploads. You (or your accountant) can export reports like balance sheets, income statements, or transaction files from QuickBooks, Xero, or other tools, and then upload them directly into the platform. This way, you’ll still get real-time alerts and insights—just without the live sync.

Which platforms does BVS integrate with?

Biz Vital Signs connects with popular tools that small businesses already use. Currently, we integrate with QuickBooks, Xero, Stripe, and other financial and payment platforms. We’re also expanding to include more marketing and operations tools, so you can see everything that matters for your business in one place.

Can I upgrade or cancel at any time?

Yes. Biz Vital Signs is built to be flexible for small businesses. You can upgrade your plan whenever you need more features, or cancel anytime with no hidden fees. Your data remains safe and secure, and you’ll always be in control of your subscription.

How many AI alerts do I get in the free plan?

With the free plan, you get a limited number of AI alerts each month—enough to monitor your most important business metrics. This helps you experience how Biz Vital Signs works before upgrading to a paid plan for unlimited alerts and deeper insights.

When will the MVP be available?

Our MVP will be available in [Month, Year]. Early users can sign up now to join the waitlist and get notified as soon as it goes live

Who is BVS designed for?

BVS is built for business owners, finance teams, and accountants who want to simplify bookkeeping and catch errors early. It’s especially useful for small to mid-sized businesses that need real-time visibility into their financial data without relying only on manual reviews.

Still have questions?

Can’t find the answer you’re looking for? Please chat to our friendly team.

Join the waitlist

Sign up to our waitlist for exclusive launch access.

Ellen Mornu is an accomplished finance professional with over 8 years of experience and a track record of driving growth, transformational changes, and robust operational management. She worked with the biggest real estate firm in Nigeria at the start of her career before joining UBA Pensions Custodian Limited, a subsidiary of the United Bank for Africa (UBA) as a financial analyst, risk analyst, and performance measurement analyst. Before joining Biz Vital Signs, she worked with two startup firms; Moove Africa (Uber’s fleet partner for Sub-Saharan Africa) and Anyscope Limited (A fintech company). She has a Master’s in financial and business economics from the University of Essex, United Kingdom, a BSc in Economics from Madonna University, Okija, and is also a member of the Association of Certified Chartered Accountants (ACCA). Ellen is dedicated, adaptable, proactive, and result-driven. Her wealth of experience has driven her to focus and specialize in business operations management for startups and SMEs.

Ellen Mornu is an accomplished finance professional with over 8 years of experience and a track record of driving growth, transformational changes, and robust operational management. She worked with the biggest real estate firm in Nigeria at the start of her career before joining UBA Pensions Custodian Limited, a subsidiary of the United Bank for Africa (UBA) as a financial analyst, risk analyst, and performance measurement analyst. Before joining Biz Vital Signs, she worked with two startup firms; Moove Africa (Uber’s fleet partner for Sub-Saharan Africa) and Anyscope Limited (A fintech company). She has a Master’s in financial and business economics from the University of Essex, United Kingdom, a BSc in Economics from Madonna University, Okija, and is also a member of the Association of Certified Chartered Accountants (ACCA). Ellen is dedicated, adaptable, proactive, and result-driven. Her wealth of experience has driven her to focus and specialize in business operations management for startups and SMEs.